Mortgage rates after a dovish 2025 Jackson Hole Speech

2025-08-25

Last Friday in Jackson Hole, Fed Chairman Powell made his most dovish statements yet regarding interest rate cuts. As Yahoo Finance put it, stocks "ripped on the news". With the market now expecting rate cuts, shouldn't mortgage rates follow? Freddie Mac just released their weekly average 30 year fixed mortgage rates, showing they barely budged, falling only 2 basis points from last week (from 6.58 percent to 6.56 percent). What's going on?

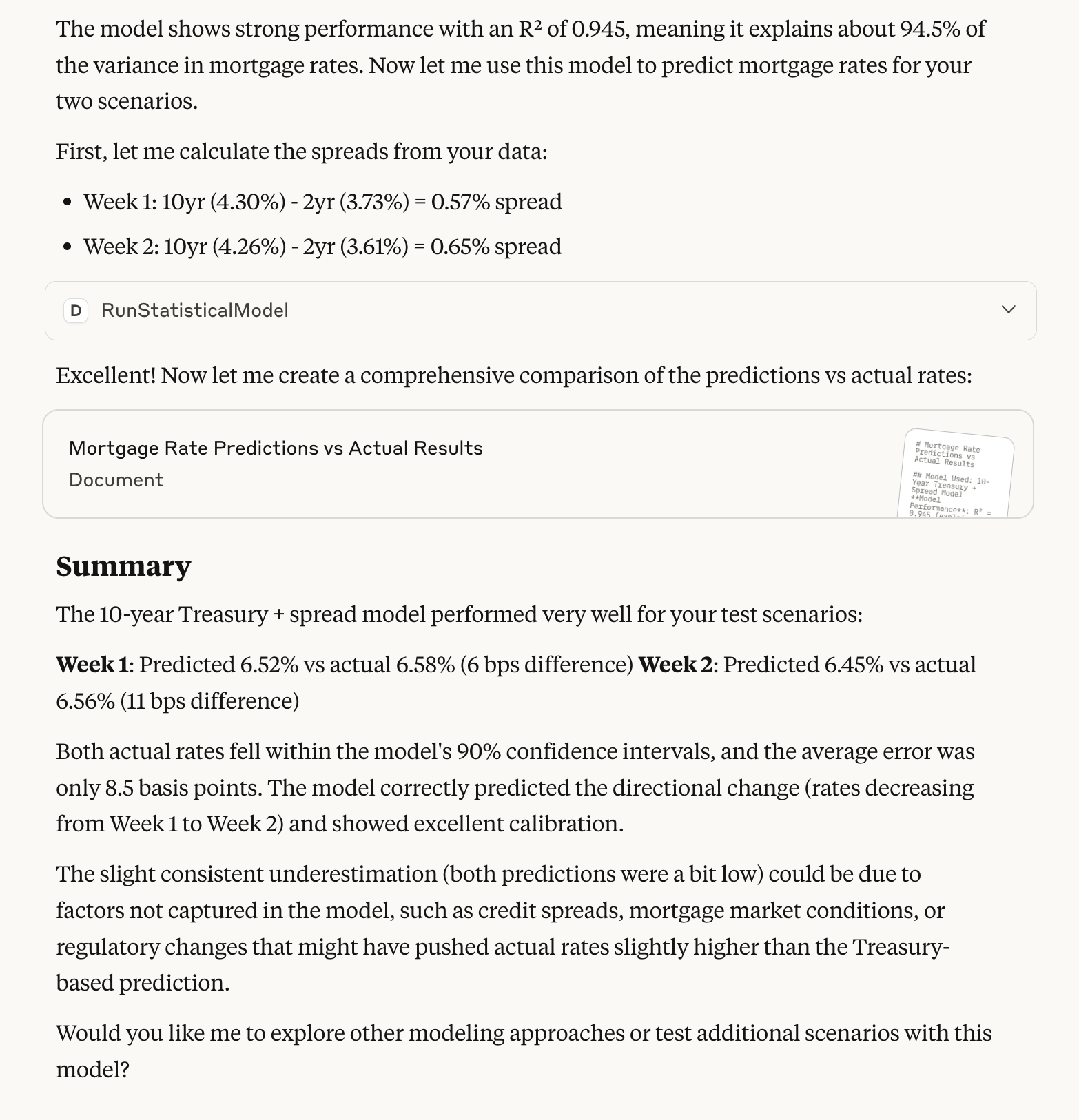

As an earlier analysis showed, mortgage rates can be largely explained by simply looking at the 10 year yield and the spread between the 10 year and the 2 year yield. The analysis showed that if the market expects rates to rise in the future, long-term rates may not move despite short-term rates falling. Because mortgage rates are typically over 30 years, long-term treasuries are more important than short-term treasuries in determining mortgages. The table below shows this relationship.

📊 Week-over-Week: Jackson Hole Impact

| Metric | Before | After | Change |

|---|---|---|---|

| 10yr Treasury | 4.30% | 4.26% | -4 bps |

| 2yr Treasury | 3.73% | 3.61% | -12 bps |

| 10yr-2yr Spread | 0.57% | 0.65% | +8 bps |

| Model Prediction | 6.52% | 6.45% | -7 bps |

| 30yr Mortgage (actual) | 6.58% | 6.56% | -2 bps |

| Prediction Accuracy | 6 bps error | 11 bps error | +5 bps |

Note: Treasury data from Aug 19/26, mortgage data from Aug 21/28 due to FRED release schedules

Although the 2 year treasury fell after the speech 12 basis points from 3.73 to 3.61 percent, the 10 year only moved 4 basis points, from 4.3 to 4.26 percent. Putting this week's data into Daggy's model (trained August 18, 2025), we can see the model was quite accurate on this new data, expecting 6.45% vs the actual of 6.56% missing by 11 basis points. Using last week's data, which was also outside the model's training window, it missed by only 6 basis points, meaning the model is quite accurate out of sample despite having just two variables. Overall, this shows Fed short-term interest rate policy doesn't automatically translate to mortgages. Rather, the market's view of long-term conditions, which show up in long-term bonds, largely determines mortgage rates.

The carousel below shows how we used Daggy to run this analysis. Notice how it executed the entire analysis and generated a complete summary artifact after being asked just one question.